ECES has established a system complying with EU and international standards. The management and internal control systems and procedures shall be designed to:

- Achieve the objectives of the programmes implemented by ECES in accordance with the principle of sound financial management.

- Safeguard the ECES assets and information.

- Prevent and detect irregularities, errors and fraud and ensure budgetary lines are appropriately followed.

- Identify and prevent management risks in accordance with ECES risk register.

- Ensure reliable production of financial and management information.

- Keep supporting documents relating to and subsequent to budget implementation and budget implementation measures.

Concerning the funding and applicable rules:

- When implementing either EU or other donor’s funds, ECES applies international financial management standards including the principles of the EU Financial Regulation applicable to the General Budget of the Union and its Rules of Application

- To that end ECES shall respect the principles of legality, regularity, effectiveness, efficiency and economy.

- The principle of economy requires that the resources used by ECES for the pursuit of its activities shall be made available in due time, in appropriate quantity and quality and at the best price (‘value for money’).

- The principle of efficiency is concerned with the best relationship between resources employed and results achieved.

- The principle of effectiveness is concerned with attaining the specific objectives set and achieving the intended results.

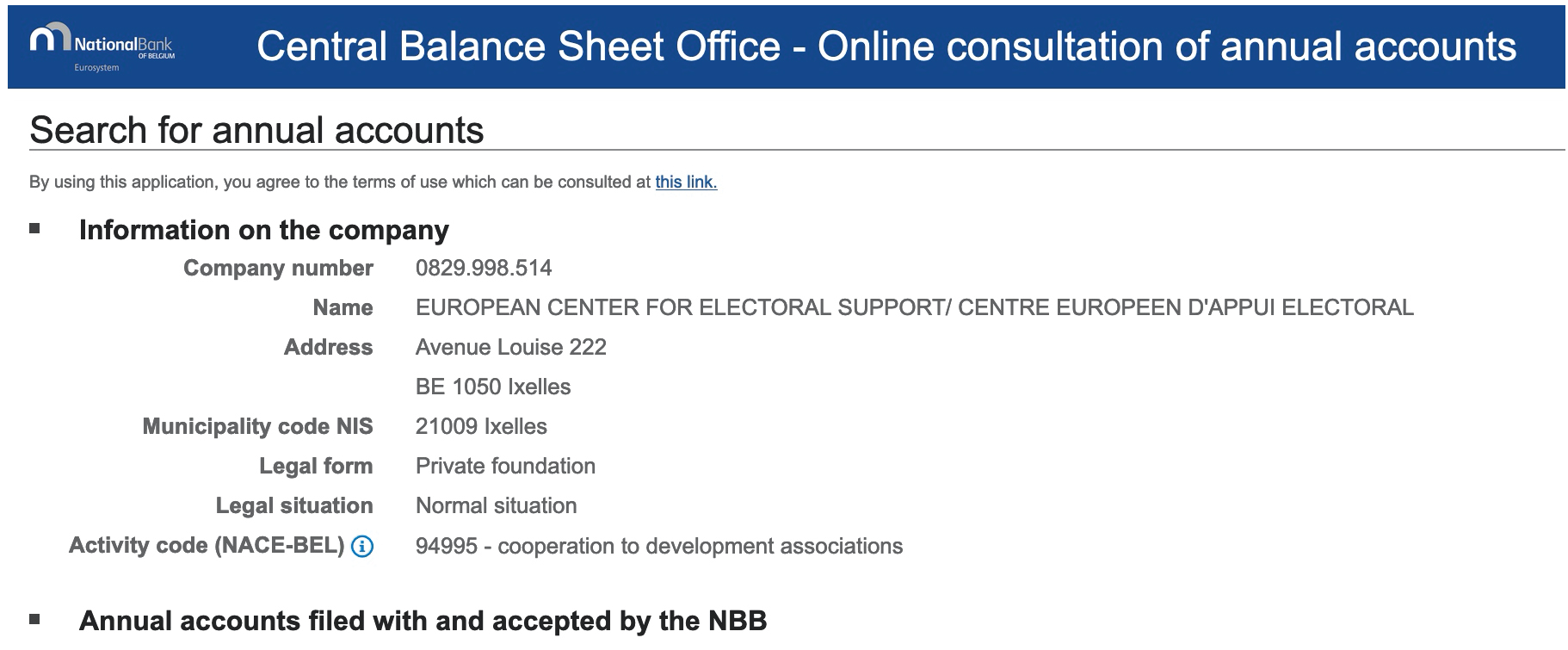

Annual Accounts and Audits

All of ECES annual accounts since 2011 have been audited. The accounts of 2022 have been audited and will later be published by the National Bank of Belgium.

You can find the latest narrative report related to the audit of our latest accounts here

Since its creation, ECES has signed contracts worth a total of 129.103.463 million Euros.

TRACE Certification

Since May 2020, ECES officially received the TRACE certification, a heavily benchmarked and comprehensive due diligence review, analysis and approval process. Organisations that are certified by TRACE, such as ECES, are pre-vetted partners for multinational companies and organisations seeking to carry out their activities and business with suppliers, agents and consultants who share their commitment to commercial and financial transparency.

Since May 2020, ECES officially received the TRACE certification, a heavily benchmarked and comprehensive due diligence review, analysis and approval process. Organisations that are certified by TRACE, such as ECES, are pre-vetted partners for multinational companies and organisations seeking to carry out their activities and business with suppliers, agents and consultants who share their commitment to commercial and financial transparency.

ECES' TRACEcertification was annually renewed.

The TRACE certification review process is based on internationally accepted standards and required ECES to complete global anti-bribery training, adopt a code of conduct and update our due diligence information annually. Reports include daily screening of names against international sanctions and enforcement lists.

EU Transparency Register

Being the EU one of the most important ECES interlocutors, and because of the shared overarching value of transparency and accountability, ECES is part of the EU transparency register, an initiative designed to make EU decision-making more open. The register is a public website where organisations representing particular interests at EU level register and up-to-date information about those interests. The EU transparency register also provides open information on what interests are being represented at EU level, who represent such interest and the related budget to lobby activities. Within this context, ECES endorsed the code of conduct governing relations of interest representatives with the EU institutions.

Quality Financial Management Strategy

ECES has developed a quality financial management strategy through its long-standing collaboration with PME-Conseils , a company specialised in accounting, business management and taxation set up in 1987 in Brussels. PME-Conseils is ISO 9001 certified and specialised in financial management support of not-for-profit organisations. ECES has been collaborating with PME-Conseils' owner, Cathy Lespiaucq, for numerous years. Besides the usual services in the area of accounting, administration and taxation specific to non-profit associations and other organisations in the non-profit sector, PME-Conseils supports ECES in carrying out:

ECES has developed a quality financial management strategy through its long-standing collaboration with PME-Conseils , a company specialised in accounting, business management and taxation set up in 1987 in Brussels. PME-Conseils is ISO 9001 certified and specialised in financial management support of not-for-profit organisations. ECES has been collaborating with PME-Conseils' owner, Cathy Lespiaucq, for numerous years. Besides the usual services in the area of accounting, administration and taxation specific to non-profit associations and other organisations in the non-profit sector, PME-Conseils supports ECES in carrying out:

- Financial and cost accounting specifically adapted to the supervision of projects or specific budgets, and adapted to the needs of the reports that have to be drawn-up;

- Financial accounting in accordance with the applicable rules and standards for non-profit

- Budgetary and financial reports according to the requirements of each sponsor;

- Preparation of financial audits by the subsidising authorities;

- Declaration and management of taxation including VAT with local relevant authorities.

Accountancy Software

ECES has been using WinBooKs as its accountancy software since its starting while a dedicated software was created with PME-Conseils and Logidrive taking on board several years of financial operations and in order to have one only customised software to deal with logistics management, billing, inventory management and purchase management.